PassimPay: Cryptocurrency Wallet Review

PassimPay is an innovative payment system that offers its clients anonymity in usage and access to a wide range of over 45 different cryptocurrencies. To start using this modern payment service with low fees, users simply need to provide their email address and spend a few minutes of their time.

With the diversity of cryptocurrencies and wallets in the market, users have been given a wide choice of tools to manage their digital assets. In this context, PassimPay has become a significant player, rapidly gaining popularity in the online community and attracting both individual users and representatives of the internet business.

Particular interest in the platform is shown by owners of investment projects. With the departure of many wallets from the market, they consider this payment system as a reliable alternative for integration with their projects.

PassimPay is a multi-currency wallet that enables working with various cryptocurrencies and stablecoins at low fees. Special attention should be given to the complete confidentiality offered by this service. During registration, clients are not required to provide personal data, and verification is also not necessary. This anonymity, combined with excellent functionality, attracts an increasing number of customers from around the world to use PassimPay.

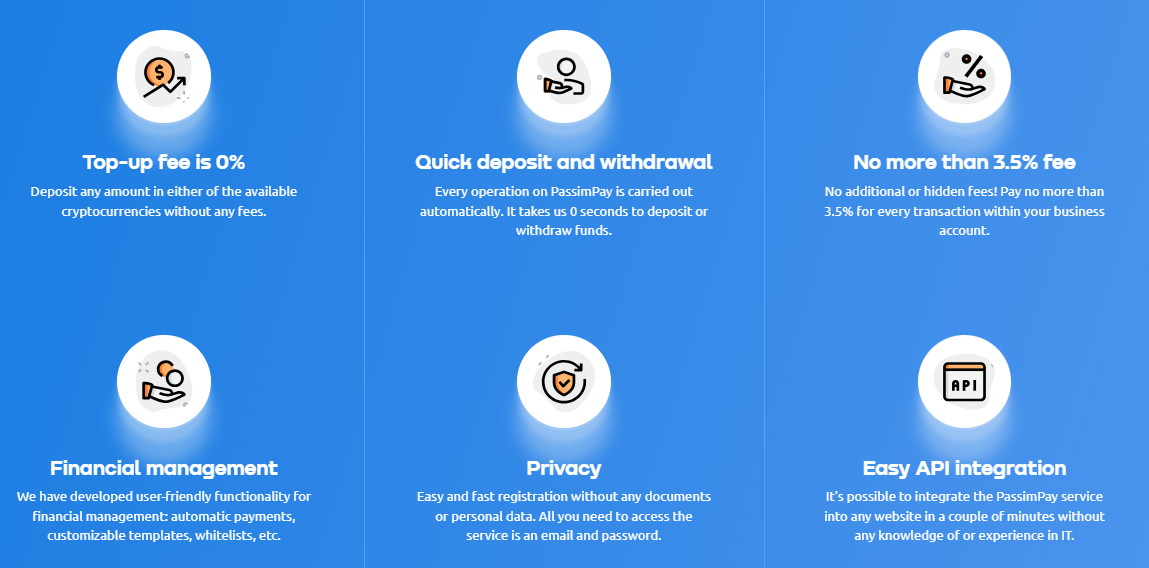

Pros and Cons of PassimPay Wallet

- No need to provide personal documents or other personal information to create an account. Users can register and start using all system features without unnecessary formalities.

- The platform offers clients a multi-currency wallet where they can store and manage over 45 different cryptocurrencies. The list of supported currencies is constantly expanding, providing greater flexibility for users.

- The service processes payments instantly, ensuring fast and efficient transactions without delays.

- The transaction fee is as low as 0.1%, and account replenishment is commission-free, allowing users to save on costs.

- The website is available in 11 languages, making it convenient for users from different countries to use the payment system in their native language.

- The wallet provides two-factor authentication to enhance account security. Each time users log in, they need to enter a code received on their registered email. Account access can also be restored using a master key.

- The platform offers its own application for convenient use on iOS and Android devices, providing mobile accessibility and ease of use.

- Passimpay.io offers an opportunity to earn through its affiliate program, where users can receive 5% to 10% of the system's income.

- Users can create personal or business accounts depending on their needs. Each account type has an optimal set of features to meet user requirements.

- The developers plan to introduce an internal exchange for convenient cryptocurrency operations, providing even greater flexibility in exchanging digital assets.

PassimPay offers a wide range of features and advantages, making it an attractive choice for users who want to manage cryptocurrencies and make payments with a high level of convenience, security, and efficiency.

Among the disadvantages of the payment system, the lack of support for fiat currencies can be mentioned, which may be inconvenient for users accustomed to dealing with traditional monetary means. However, as compensation, they offer a wide selection of stablecoins, which are stable digital assets tied to fiat currencies and can be a good alternative for users.

Another aspect to consider is using PassimPay as a centralized payment system. This means that users do not have direct control over their funds and rely on intermediary services. Therefore, it is important to consider both the advantages and disadvantages of centralized payment systems when deciding to use PassimPay. Overall, each user should weigh their needs and preferences before deciding if PassimPay is suitable for their individual financial goals and requirements.

PassimPay Personal Account

The Personal Account offered by PassimPay is specifically designed for individual users and comes with a range of useful features. Here are some key highlights:

- Confidentiality: Registering in the system requires only an email address and password, ensuring a high level of confidentiality.

- Secure Storage: The Personal Account provides secure storage for your assets, utilizing features such as a master key, two-factor authentication, SSL certificate, and Cloudfare protection to ensure the safety of your holdings.

- Deposit Commission: There are no commission fees for depositing funds into your account, allowing you to save on transaction costs.

- Flexible Withdrawal Fees: PassimPay offers flexible withdrawal fees for cryptocurrencies, ranging from 0.1% to 1%, depending on the network conditions.

- Notification Settings and Additional Security: Users have the ability to customize their notification settings for various operations and activate/deactivate additional security layers within their account.

PassimPay Business Account

The Business Account provided by PassimPay is tailored for online stores, e-commerce projects, and companies that wish to accept cryptocurrency payments. Here are the notable features it offers:

- Seamless API Integration: The Business Account ensures easy and fast integration through comprehensive instructions and code examples.

- Advanced Reporting: Users can access detailed reports tracking their account's income, expenses, and project-specific statistics at any time.

- Automated Payments and Customizable Templates: The Business Account allows users to set up automated payments, create whitelists, and utilize customizable templates for enhanced convenience.

- Deposit Commission: Similar to the Personal Account, there are no commission fees for depositing funds into the Business Account.

- Withdrawal Fees: The withdrawal fees for cryptocurrencies from the Business Account range from 0.5% to 3.5%.

PassimPay Partner Program

Partner Program provides users with an opportunity to earn passive income and contribute to the spread of the PassimPay payment system worldwide. The rewards from the partner program are expressed as a percentage of the commission paid by invited partners when withdrawing funds from the system. The partner commission size depends on the level and is set at 5%, 7%, and 10%:

- 1st level (5%): This level is available to all users and provides 5% of the commission paid by invited partners.

- 2nd level (7%): When the total withdrawal amount of partners exceeds $500,000, the user advances to the second level and receives 7% of the commission from invited partners.

- 3rd level (10%): When the total withdrawal amount of partners exceeds $1,500,000, the user advances to the third level and receives 10% of the commission from invited partners.

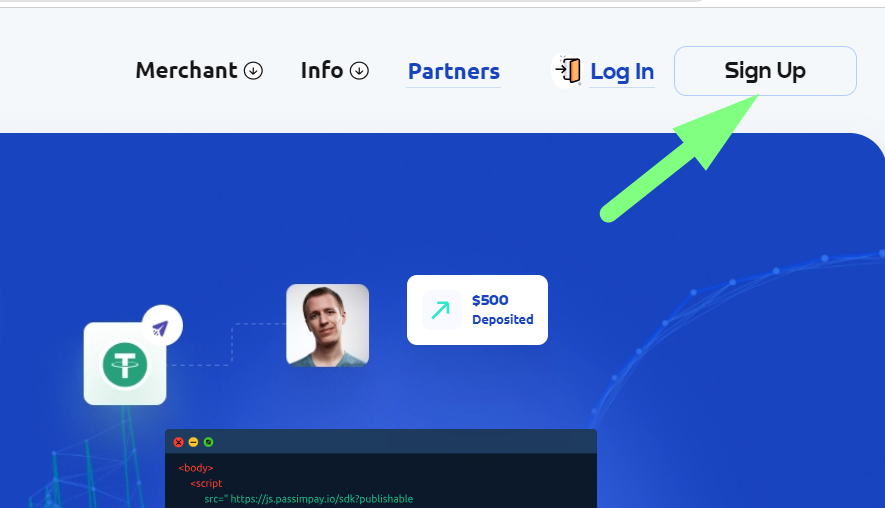

Registration on the PassimPay website

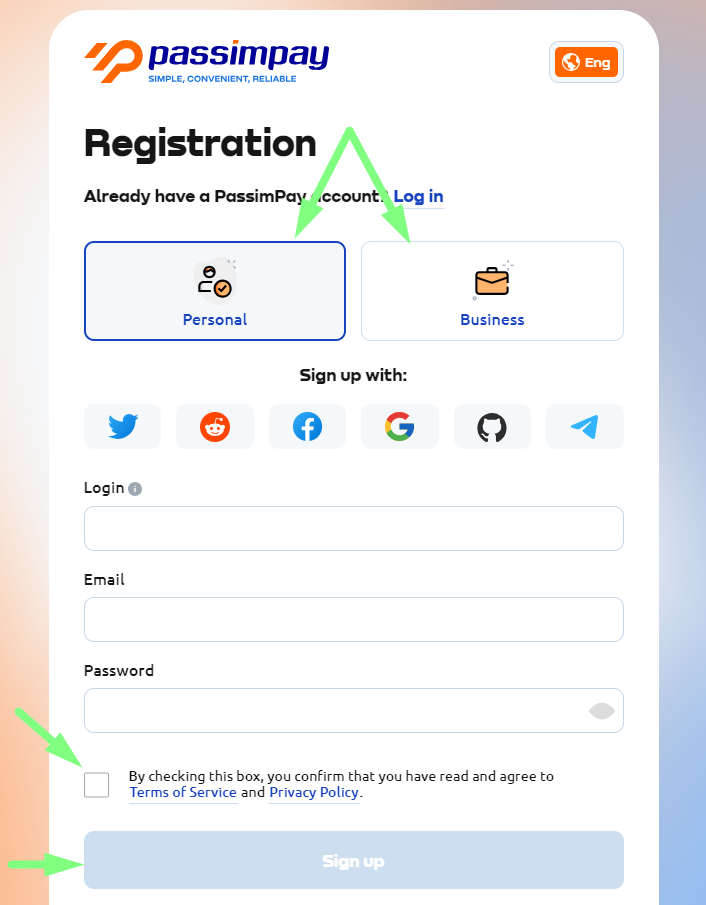

The process of creating a wallet on PassimPay is straightforward and convenient. Go to the main page of the PassimPay payment service. Find the "Sign Up" button located in the top right corner of the page and click on it.

On the registration form page that appears, you will be asked to choose the type of account you want to create: "Personal" or "Business." Select the account type based on your preference and intended use of the service. Fill in the remaining fields of the registration form, including username, email, and password. Be sure to read the user agreement and terms of use of PassimPay. If you agree to the terms, check the box or mark the field that says "I accept the terms of the user agreement" or similar. Click the "Sign Up" button to complete the registration process.

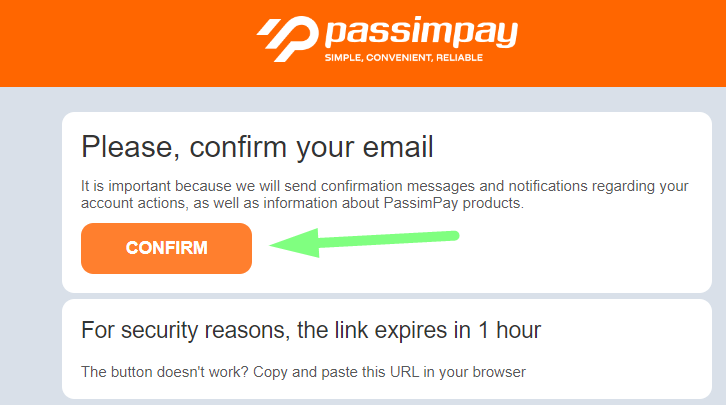

After filling out the registration form and clicking the "Sign Up" button, you will receive an email at the email address you provided. Open the email and click the "Confirm" button.

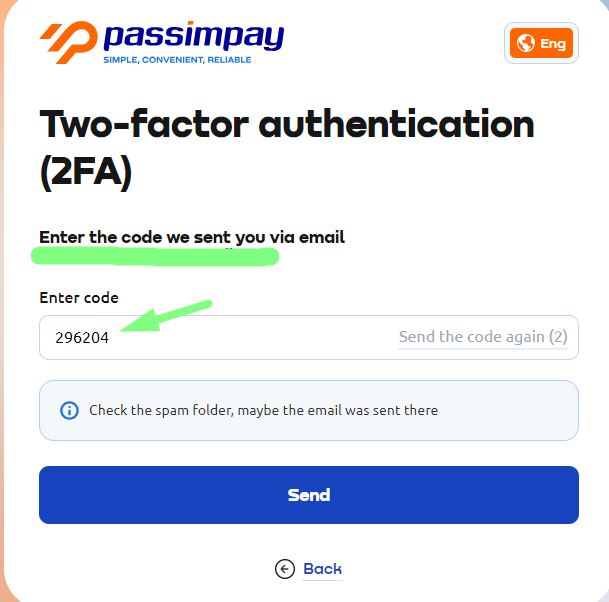

After that, the authorization form will appear on the payment service website. Enter your login credentials. During login, you will need to confirm that you are the account owner. A code will be sent to your email, which you need to enter in the form on the website.

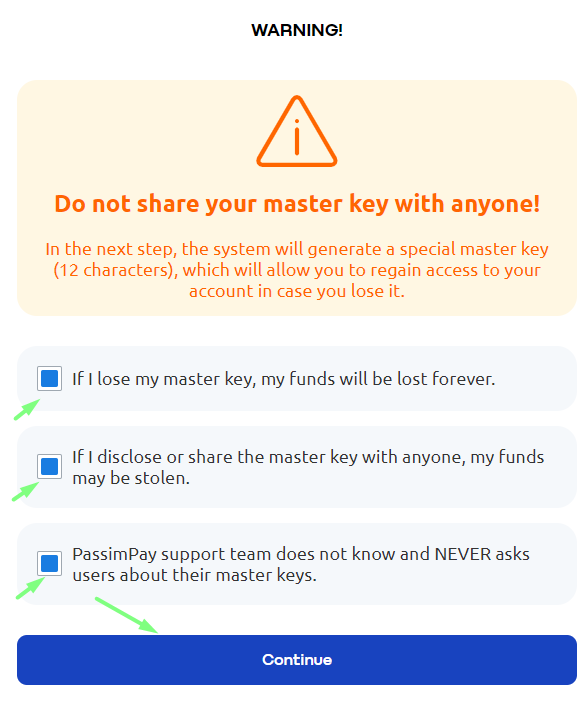

The system will generate a master key for you - a special code that you must save. Before saving it, confirm that you understand the need to keep the key and keep it secret. Then click the "Continue" button.

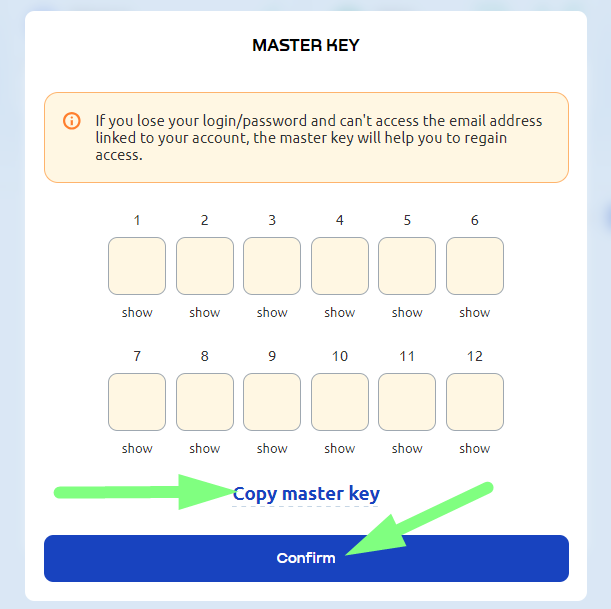

Copy the secret key and save it in a secure location, then click the "Confirm" button.

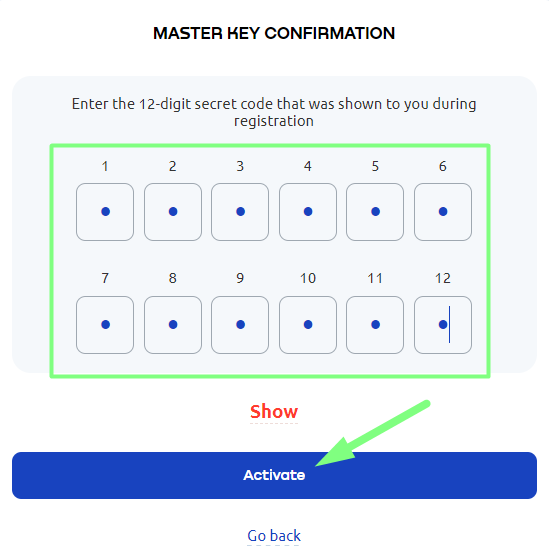

You will then be prompted to reproduce all 12 characters of the code in the correct sequence - simply copy and paste it. After that, click the "Activate" button.

PassimPay Wallet Review

PassimPay offers the ability to work with popular cryptocurrencies with complete confidentiality. It provides all the necessary tools for quick and convenient deposit and withdrawal of funds. Special attention should be paid to the API, which easily integrates into various projects without unnecessary complexities. The user-friendly interface and availability of multiple language versions make the process of account registration and wallet security setup simple and accessible. Additionally, PassimPay ensures full user confidentiality and allows wallet security to be customized according to individual needs.

Top Profitable

- Safeassets264.6%

- Dividend Growth175%

- Arbill166.6%

- Espino136%

- Luxioprofit134%

- Asignat131.7%

- Citadella128%

- Bitcobid128%

- Bitcoinwealth126%

- Uctraders125%

- AiTiMart103.5%

- Planetary Asset70.6%

- Conspro46.56%

- Iiiuminate41.5%

- EXXE11%

Top Monitored

- Espino790 days

- Bitcobid789 days

- Uctraders779 days

- Luxioprofit768 days

- Asignat762 days

- Arbill751 days

- Safeassets736 days

- Bitcoinwealth522 days

- Dividend Growth515 days

- Citadella494 days

- Iiiuminate222 days

- Conspro218 days

- Planetary Asset192 days

- AiTiMart83 days

- EXXE68 days

Payment System

Last Votes

- Apr 28th, 2024

Stakingi

Stakingi- Mar 30th, 2024

Safeassets

Safeassets- Mar 26th, 2024

Safeassets

Safeassets- Mar 24th, 2024

Safeassets

Safeassets- Mar 21st, 2024

Safeassets

Safeassets- Mar 14th, 2024

Safeassets

Safeassets- Mar 2nd, 2024

Legal Investments

Legal Investments

Last Payouts

- Apr 26th, 2024

- Planetary Asset$6.00

- AiTiMart$35.00

- Stakingi$1.00

- Dividend Growth$5.20

- Bitcoinwealth$2.00

- Asignat$4.00

- Arbill$3.20

- Espino$10.00

- Uctraders$2.00

- Bitcobid$2.00

Top Profitable

- Safeassets264.6%

- Dividend Growth175%

- Arbill166.6%

- Espino136%

- Luxioprofit134%

- Asignat131.7%

- Citadella128%

- Bitcobid128%

- Bitcoinwealth126%

- Uctraders125%

- AiTiMart103.5%

- Planetary Asset70.6%

- Conspro46.56%

- Iiiuminate41.5%

- EXXE11%

Last Scams

Available Now for $20.00/week

Available Now for $20.00/week

Available Now for $16.00/week

Available Now for $16.00/week

Available Now for $25.00/week

Available Now for $25.00/week